[ad_1]

Again in 2013, salespeople for BlackRock known as to let us know about their new collection of iShares exchange-traded finances (ETFs) with dramatically decrease charges. They obviously anticipated us to percentage their pleasure, and soar on the probability to provide the finances to our shoppers. In any case, BlackRock is the large of the ETF global, and we’ve all the time been abundantly transparent in regards to the significance of securing decrease expense ratios for our shoppers.

They had been gobsmacked once we stated no thank you.

Why did we react that manner? We would like companions which might be wholeheartedly dedicated to reducing buyers’ prices, and BlackRock didn’t move the check. Whilst the brand new low cost finances had been a good way to draw new property, they did not anything for the hundreds of thousands of people who owned older iShares finances—and who couldn’t business them in for the brand new ones with out incurring large tax hits on their known positive factors.

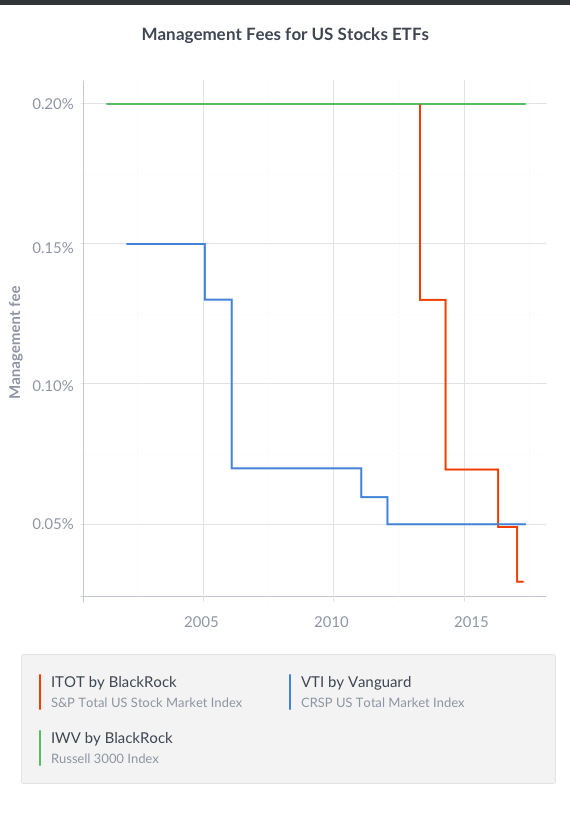

As a substitute, we opted to stay with a spouse with a confirmed document of placing shoppers first: the Leading edge Team. The chart underneath presentations the control charges Leading edge and BlackRock price for his or her General US inventory marketplace ETFs. As you’ll see from the blue line, Leading edge has frequently diminished its charge through the years for VTI. By contrast BlackRock’s IWV (inexperienced line) has had the similar charge for the final 17 years. It handiest offered a lower-cost model of the fund, known as ITOT (purple line), as a part of a brand new “Core” emblem of finances in 2013, after years of shedding important marketplace percentage to Leading edge.

As you’ll see from the chart underneath, the adaptation in worth between BlackRock’s primary rising marketplace ETF and its more recent “Core” rising marketplace fund is much more distinguished. As is its follow, Leading edge continuously diminished its charge through the years, whilst BlackRock maintained a vital worth top rate for the ETF wherein its shoppers had a vital capital achieve. On this case the associated fee distinction is 0.58%. That’s a huge distinction!

Regardless of this habits, BlackRock continues to get numerous favorable press from analysts and monetary newshounds for reducing its charges for a few of its finances. If BlackRock used to be prepared to stiff the majority of its consumers up to now, how may just we make sure it might act in the most efficient pursuits of our shoppers sooner or later?

With Leading edge, we’re positive. The corporate has lower the charges on all its finances on a semi-regular foundation because it used to be based in 1974—no longer in response to a transfer by means of a competitor, however just because it will. The newest transfer got here in February. All informed, Leading edge claims its expense ratios are 83% not up to the trade moderate, and one analyst estimates the corporate has stored buyers $1 trillion since its inception.

I’m no longer so naïve as to suppose it is a easy case of excellent guys as opposed to dangerous guys. It’s in reality a mirrored image of company construction. Leading edge is basically a non-profit, as a result of it’s owned by means of the buyers in its finances. Due to this fact any income it earns are returned to the buyers in its finances within the type of decrease charges. By contrast, BlackRock is a for-profit publicly traded corporate. It stays extremely depending on control charges from ETFs, which have been the supply of kind of a 3rd of its $11.1 billion in earnings in 2016. Chopping charges on all their ETFs to Leading edge costs (no longer simply their new “core” percentage categories) would charge BlackRock over $500 million in income, which might be a nearly 20% hit to their income. It due to this fact shouldn’t be a marvel that BlackRock designed this ruse to care for their profitability.

Whilst we like the usage of Leading edge ETFs, they don’t seem to be all the time the perfect selection for our shoppers. As we defined in How To Pick out An ETF, we make a choice ETFs in line with their charges, liquidity and monitoring error. We these days be offering BlackRock’s ten-year-old muni bond ETF (MUB) as a result of Leading edge’s 20-month-old muni ETF (VTEB) isn’t just about as massive – and we don’t need to be this kind of massive proportion of its property that our trades would have an effect on its efficiency. However Leading edge these days fees a charge of 0.09% as opposed to 0.25% for BlackRock. Our guess is that through the years, Leading edge will construct the liquidity had to justify us switching to VTEB.

The funding trade does numerous unseemly issues to maximise their income on the expense in their shoppers, all whilst overlaying it up with suave advertising and marketing campaigns that make you’re feeling like you’re the precedence. At Wealthfront, we no longer handiest say we’re dedicated to all the time placing our shoppers’ pursuits first, we now have designed a trade style that actually helps this function. We put our cash the place our mouth is. Even though this implies we would possibly forfeit some temporary income by means of charging the lowest-possible charges, we consider providing a greater deal is one of the best ways to inspire extra other folks to check out our software-based method to making an investment. Go searching and also you’ll see that enormous, well-run application companies typically have little drawback out-earning extra labor-intensive conventional companies. In different phrases, handing over you worth in a lovely manner must in the end result in an overly a success trade.

[ad_2]