[ad_1]

An making an investment earthquake is underway and it is threatening to finish conventional cash control as we are aware of it.

Traders are pouring their cash into so-called passive index finances that blindly observe marketplace indexes the usage of computer systems.

It is a shift this is coming on the expense of finances which can be run through mere mortals, aka invesment managers, who check out to pick out shares that can outperform the marketplace.

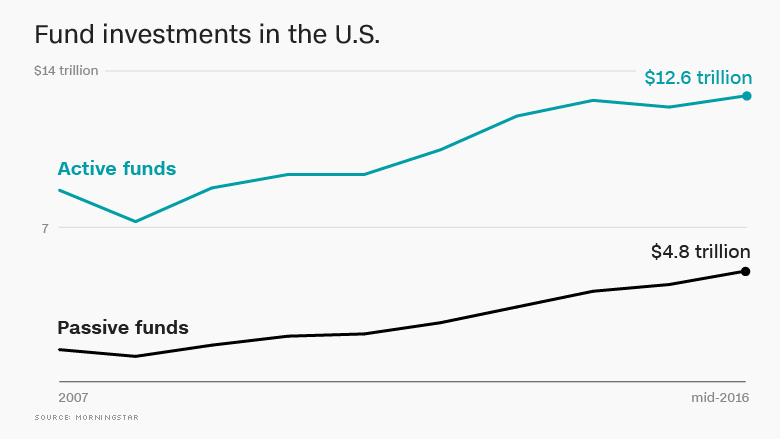

The craze is particularly pronounced in the USA, the place 28% of the trade’s $17 trillion in property are these days invested in passive finances, up from simply 13% in 2008, in step with knowledge from marketplace analysis company Morningstar.

American buyers have plowed a complete of $671 billion into passive finances for the reason that get started of 2015, whilst pulling $257 billion out of so-called energetic finances run through managers over the similar length.

Distinguished BlackRock (BLK) CEO Larry Fink predicted this week that regulatory adjustments within the trade will inspire much more cash to glide into those finances.

“We’re more likely to see a ancient shift on how property are being controlled,” he stated. “[Investors] will use [passive funds] increasingly more on the middle in their portfolios.”

BlackRock’s (BLK) fashionable iShares trade, which provides buyers passive exchange-traded finances (aka ETFs), noticed $51 billion in internet inflows over the last quarter whilst the company’s energetic finances introduced in not up to one-tenth that quantity.

Whilst it is tempting to speculate with most sensible funding managers who promise to outperform the marketplace, analysis has proven that this technique continuously ends up in smaller returns.

“Actively controlled finances have normally underperformed their passive opposite numbers, particularly over longer time horizons,” stated Morningstar researchers in a up to date paper.

The cause of the lackluster efficiency of energetic finances generally comes again to funding charges — which might be a lot upper at energetic finances. (Laptop algorithms would not have children to feed again at house!)

Similar: How will have to I make investments a $250,000 providence?

However some marketplace strategists warn that passive making an investment is turning into a crowded business, with too many of us hopping onto the bandwagon.

“Indexing and ETFs be offering super worth as a part of the marketplace, however they will have to no longer grow to be the marketplace. If that is an investor’s singular technique to the markets, it represents a pursuit of mediocrity,” stated Mike O’Rourke, leader marketplace strategist at JonesTrading.

CNNMoney (London) First printed October 20, 2016: 6:36 AM ET

[ad_2]