[ad_1]

Wall Boulevard banks desire purchasers with tens of millions — if no longer billions — to take a position. Squaddies, nurses and development employees generally don’t seem to be anyplace close to that rich.

That is why a rising choice of reasonable Joes are turning to an app known as Stash as a substitute. On Stash, you’ll get started making an investment with simply $5. The corporate’s motto is “making an investment for actual other people.”

“Numerous our customers get started making an investment with not up to $100. For us, that is nice as a result of they have taken that first step. They are finding out,” says Brandon Krieg, co-founder and CEO of Stash.

Stash introduced ultimate fall. It already has over 150,000 customers. About 10% of the ones are active-duty army, says Krieg. It is a excessive share bearing in mind not up to part a % of the U.S. inhabitants total these days serves within the military.

“Stash is the answer for tens of millions of American citizens historically overlooked or taken benefit of via large making an investment companies,” says Krieg. “Nearly all of our consumers are first-time traders.”

Similar: 10 best possible making an investment apps

Along with army group of workers, the app could also be well liked by people who find themselves self-employed, together with Uber drivers.

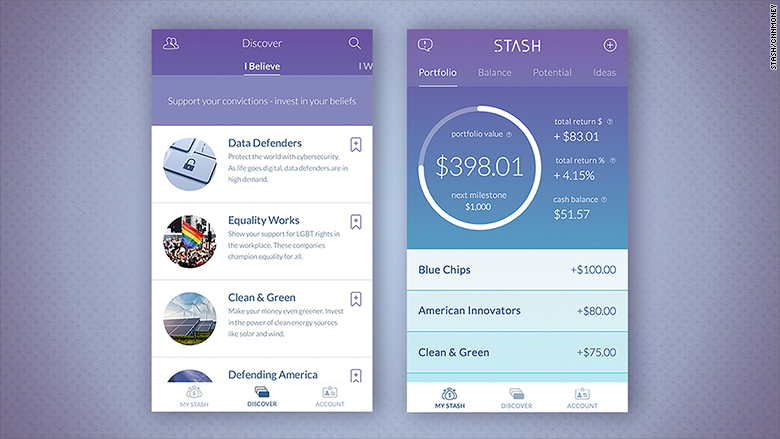

Stash makes making an investment extremely easy. There are best 33 funding choices, which is far more uncomplicated than navigating the universe of 1000’s of shares and finances.

The app is helping steer you in the appropriate route, however you continue to get to make the overall determination. That is other than the so-called “roboadvisor” apps like Wealthfront and Betterment, the place a pc makes a decision easy methods to make investments your cash.

The co-founders of Stash sought after other people to learn to make investments, no longer simply give up their cash.

“Monetary literacy on this nation is a big drawback,” Krieg informed CNNMoney. The Stash app is ready to unveil a brand new characteristic known as “be told” to lend a hand train customers much more.

Similar: My process just about drove me to dedicate suicide

To get going, the Stash app asks a couple of fundamental inquiries to resolve if anyone is pleased with low, medium or high-risk making an investment. As you may be expecting, most of the people fall within the center.

Stash encourages most of the people to place no less than a few of their cash into the “Reasonable Combine” fund. Call to mind it like vanilla ice cream: An overly cast choice that also satisfies an individual’s want to develop their cash for retirement or sending a child to school.

Customers too can make a choice from different finances like “Web Titans,” “Protecting The united states,” and “Blank & Inexperienced.” Those are inventory finances, however the names were translated from Wall Boulevard jargon into standard other people discuss.

Stash will get excessive marks from customers for making making an investment simple and obtainable, however be aware of the charges. Stash fees $1 a month. That does not sound like so much, however a person actually wishes to take a position no less than $250 or extra for that degree of charges not to devour up returns.

Be expecting much more new options and expansion from Stash this autumn. This week the corporate introduced $9.25 million in a Collection A investment spherical led via Goodwater Capital.

CNNMoney (New York) First revealed August 19, 2016: 1:31 PM ET

[ad_2]